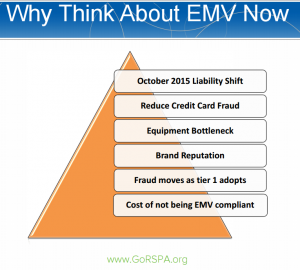

Time is running out for merchants to adopt EMV (EuroPay MasterCard and Visa) standards. Starting Oct. 1, merchant liability for payment card fraud will increase, unless they can process payments with microchip-based cards. They don’t have the capability to process payment through the chip, they become responsible for fraudulent transactions involving those cards.

Time is running out for merchants to adopt EMV (EuroPay MasterCard and Visa) standards. Starting Oct. 1, merchant liability for payment card fraud will increase, unless they can process payments with microchip-based cards. They don’t have the capability to process payment through the chip, they become responsible for fraudulent transactions involving those cards.

The liability currently belongs to card issuers, but that ends when American Express, Visa, MasterCard and Discover adopt the EMV standards in October. EMV aims to prevent credit and debit card fraud by placing computer chips in payment cards primarily for security reasons. Payment card fraud is expected to hit $10 billion in the U.S. alone this year, so the stakes are high.

Merchants who aren’t ready for the shift take a big risk, which POS dealers, developers and integrators can help them avoid with EMV-capable solutions.

Unfortunately, too many software developers and dealers aren’t ready. A March 2014 Business Solutions magazine poll revealed just over one quarter of ISVs – 28% – have become EMV-compliant while about 40 percent said they were at least six months away from compliance.

Unfortunately, too many software developers and dealers aren’t ready. A March 2014 Business Solutions magazine poll revealed just over one quarter of ISVs – 28% – have become EMV-compliant while about 40 percent said they were at least six months away from compliance.

For dealers, this limits access to EMV-capable solutions, so they have to wait for ISVs to catch up. That’s unfortunate because EMV adoption presents a significant revenue opportunity for POS solution providers. According to the EMV Migration Forum, it is potentially an $8 billion opportunity because 9 million POS terminals in the U.S. will need to be upgraded.

Nevertheless, providers should start discussing EMV standards with clients if they haven’t already done so. EMV implementations are an opportunity to replace aging POS systems with new, more flexible and affordable solutions.

Many merchants will want to eliminate their dependence on old, expensive PC-based POS systems in favor of more affordable, WiFi-capable solutions (e.g., tablets and smartphones) that help improve the shopping experience. Of course, the cash drawer is a component that should be reevaluated; some merchants may be interested in stand-alone drawers with wireless capabilities and security features their current systems lack.

Simply put, this is the right time to evaluate POS workstations and software to take full advantage of the shift to EMV. In the BSM survey, both VARs and ISVs said some merchants “may never upgrade to an EMV-certified solution because they don’t perceive the threat to be real.”

They’re bound to change their minds once they have to contend with cases of fraud for which they will now be held responsible. In any case, they will likely feel pressure from cardholders who will want to take advantage of the security features of chip-based cards.